Chainalysis, a blockchain research firm, recently published its Crypto Crime Report for 2022. Among many other findings, the report stated that the non-fungible token (NFT) market is quite vulnerable to a concept known as ‘wash trading’ – a fraudulent activity that falsely inflates the value of assets. But what is wash trading, and how does it affect NFTs? Let’s find out.

NFTs have surged in popularity, with several big-ticket sales occurring over the last few months. In fact, as per the Chainalysis

report, sales in the NFT space jumped to a whopping $44.2 billion in 2021 from $106 million in 2020. However, this digital asset is also a victim of cybercrimes and frauds, the latest of which is wash trading.

What is Wash Trading in NFTs?

The report from Chainalysis explains wash trading as “a transaction in which the seller is on both sides of the trade in order to paint a misleading picture of an asset’s value and liquidity.” In the case of NFTs, wash trading seeks to make the asset look much more valuable than it is. How is this done?

Several NFT trading platforms allow users to trade by simply connecting their wallets to the platform without identifying themselves. This means that one user can create and link multiple wallets to a platform.

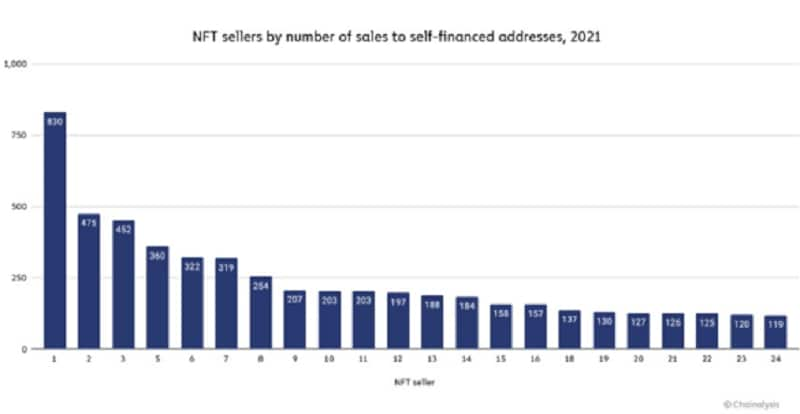

A user can then control both sides of an NFT trade, selling the NFT from one wallet and purchasing it from another. When multiple such transactions are executed, the trade volume rises. This makes the underlying asset seem highly sought after. Some wash traders have gone to the extent of making hundreds of transactions through their self-controlled wallets. Here are some of the wash trades unearthed by Chainalysis:

User 1 from the above chart carried out 830 self-financed transactions. This leads to a complex transaction chain that looks like this: (Image source: Chainalysis)

When Chainalysis dug deeper, they found 262 users who transacted with self-financed wallets over 25 times each. Interestingly, most wash traders did not profit from these transactions. In fact, of the 262 users carrying outwash trades, 152 users booked losses of around $400K. However, the remaining 110 users turned profits of around $8 million. Here’s the complete breakdown:

Fortunately, robust tools are being developed to detect such fraudulent activity. These tools can now detect whether the sale and purchase wallets are funded by the same address. Thorough scrutiny of NFT sales has brought to light hundreds of such wash trades in the NFT space.

Kim Grauer, Head of Research at Chainalysis, told Cointelegraph that the firm had created such a tool that was powerful enough to detect self-financing activities. “Overall, we found that it’s not profitable to wash trade NFTs because you end up paying a lot in gas fees. Many wash traders came out negative due to the amount spent on gas versus the amount generated from their sales,” she said.

How do NFT platforms protect users from wash trades?

Experts believe that wash trading is likely to become more common in the days to come. This is mostly due to the fact that a single user can easily create multiple Ethereum wallets. “Anyone can easily engage in wash trading — if you can download an ETH wallet and purchase an NFT, you can do it ,” Grauer said.

Alex Salnikov, Co-founder and Product Head at NFT marketplace Rarible, told Cointelegraph that platforms rewarding users for executing trades were the most exploited as they added profitability to the money-making racket. Rarible acted on Salnikov’s point, and the DAO (decentralized autonomous organisation) voted to discontinue rewarding the RARI tokens to traders. It is now impervious to wash trading.

Similarly, OpenSea also released a blog in January 2022 announcing the launch of a new ‘NFT Security Group.’ The team will focus on eliminating vulnerability issues before the repercussions reach users. They will do so by collectively brainstorming and acting on reports that are not publicly declared. Learning from the same, the group will also work on creating solutions to keep wash traders at bay and improve the overall security of the NFT platform.

0 Comments